2025 Proxy Season Review: Rule 14a-8 Shareholder Proposals

OVERVIEW

The 2025 proxy season unfurled against a rapidly shifting political and regulatory backdrop. The dizzying pace of developments from courts, as well as lawmakers, regulators, and other political actors, resulted in an unpredictable and volatile proxy season for companies, investors, proxy advisors and other stakeholders. Broadly speaking, for H1 2025 annual meetings, companies (1) received shareholder proposals during the period between the presidential election and inauguration, (2) explored no-action relief as the SEC was revising its Rule 14a-8 guidance to increase the availability of exclusionary relief (see Section D) and (3) received proxy advisor recommendations and shareholder votes after the Trump administration issued Executive Orders and took other measures on prevalent Rule 14a-8 topics, such as diversity, equity and inclusion (“DEI”).

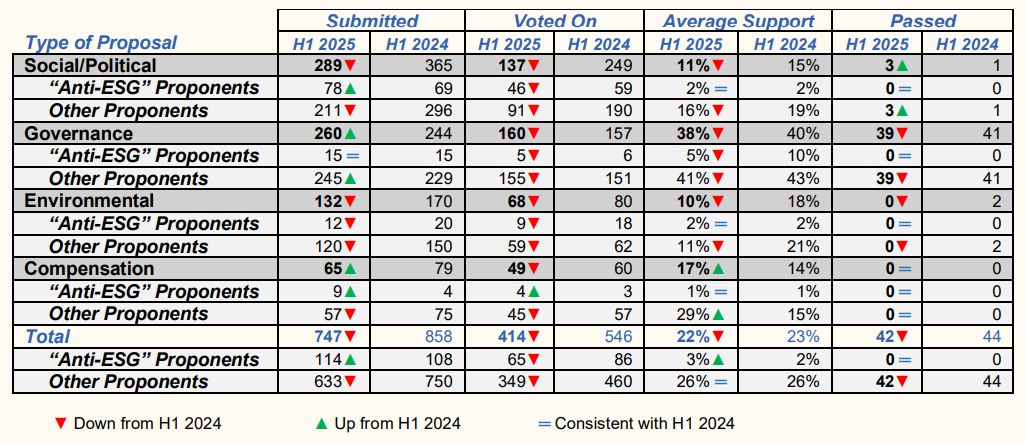

Submitted Proposals. The number of submitted proposals declined for the first time since 2020, decreasing by 13% compared to H1 2024. Although environmental, social and political (“ESP”) proposals continued to represent the majority of submissions (57% vs. 62% in H1 2024), proposals on ESP topics decreased in H1 2025 while governance proposals increased, narrowing the gap between the categories.

Voted Proposals. Compared to submissions, the number of voted proposals declined by a more significant margin, down 24% compared to H1 2024. Only 55% of proposals reached a vote, compared to 64% during the same period last year. In particular, the number of voted social/political proposals decreased by 45% compared to H1 2024.

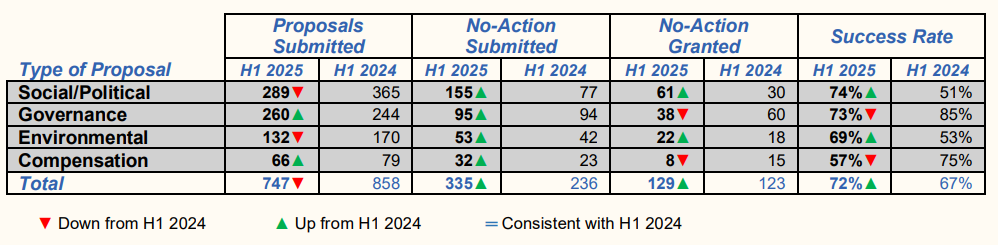

Excluded Proposals. The decrease in voted proposals reflected the high volume and success of no-action requests, consistent with a marked change in the SEC’s position. Companies requested no-action relief with respect to 45% of submissions for H1 2025 meetings (vs. 28% for H1 2024). This represented a 42% year-over-year increase in the volume of requests (335 vs. 236 for H1 2024, more than doubling the number for H1 2023). The percentage of requests granted by the SEC increased by only 5% overall (72% vs. 67% for H1 2024), but a category-by-category examination reveals more meaningful trends. The percentage of successful requests increased by 24% for social/political proposals and 16% for environmental proposals, but decreased by 11% for governance proposals and 18% for compensation proposals. These year-over-year statistics also obscure the effect of withdrawn no-action requests by companies, which occurred with respect to 46% of no-action requests made for H1 2025 (vs. 22% for H1 2024).[2] Overall, 17% of all proposals submitted for H1 2025 meetings were excluded through the SEC process (vs. 15% for H1 2024).

Shareholder Support. Although overall shareholder support for voted proposals remained level, average shareholder support for ESP proposals decreased by 31% compared to H1 2024. Generally consistent with the 2024 proxy season, only around 10% of voted proposals passed,[3] almost all in the governance category.

B. WHO MAKES SHAREHOLDER PROPOSALS

Decreasing Submissions from “Traditional” Proponents. Proposals from the top 10 proponents once again accounted for a substantial majority of submissions. Other than John Chevedden, who maintained his position as the top proponent and whose submissions increased this year (256 vs. 199 last year, representing over one-third of all submissions and half of all governance submissions), submissions from other “traditional” proponents decreased. For example, submissions from religious organizations, which continued to focus on social/political topics, fell by 19%. Submissions from social investment entities, which remained the primary drivers of environmental proposals, also decreased by close to 10%. Whereas the 2024 proxy season was marked by a high level of union activity, unions submitted only 27 proposals for H1 2025 meetings (compared to 75 for H1 2024).

Submissions from “Anti-ESG” Proponents Remain High. Proposals from “anti-ESG” proponents grew from 25 in full-year 2021 to over 100 for the first time in H1 2024.[4] In H1 2025, the number of these proposals further increased to 114, representing 15% of all proposals (compared to 13% in H1 2024).

Many high-profile companies received proposals calling for diverging approaches on the same topic, particularly where DEI was concerned. For example, after a number of companies rescinded or reduced their DEI commitments in 2024 (including in response to campaigns from social media activist Robby Starbuck), social investment entities (i.e., ESG funds and other institutions with a mandate to make “socially responsible” investments) submitted proposals demanding that companies expand or reinstate corporate DEI initiatives. Meanwhile, “anti-ESG” proponents called for companies to consider the legal and commercial risks associated with DEI initiatives, citing recent Supreme Court decisions in Harvard and Groff. [5] In some cases, after initially submitting their proposals in late 2024, these proponents followed up with exempt solicitations or other statements when President Trump issued Executive Orders in January outlining the administration’s position on potentially illegal DEI practices.

Consistent with last year, companies requested to exclude proposals from “anti-ESG” proponents at a higher rate than for proposals from other proponents, with no-action requests submitted for 63% of proposals from “anti-ESG” proponents (vs. 44% of other proposals). The success rate for requests to exclude proposals from “anti-ESG” proponents continued to decrease (to 34% vs. 41% for H1 2024 proposals), in stark contrast with the 2023 proxy season, when proposals from “anti-ESG” proponents were more than twice as likely to be excluded than other proposals (76% success rate for requests to exclude proposals from “anti-ESG” proponents vs. 49% for other proposals).

Settlements with “anti-ESG” proponents remained rare, and proposals from these proponents went to a vote in almost all cases where they were not excluded. When voted, these proposals continued to garner very low levels of support, generally less than 3% of the vote.

C. TARGETS OF SHAREHOLDER PROPOSALS

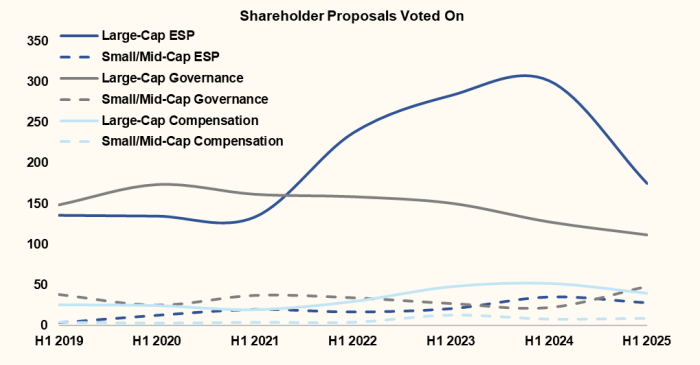

Fewer Voted Proposals at Large-Cap Companies. Large-cap companies continued to receive the vast majority of shareholder proposals, but proposals at the S&P 500 accounted for a lower portion of all voted proposals (78% vs. 88% in H1 2024), partly due to higher numbers of successful no-action requests and withdrawals at large-cap companies. [6] Unlike last year, proposals were more likely to reach a vote at small- and mid-cap companies than at large-cap companies, with 57% of submissions reaching a vote at small- and mid-cap companies (vs. 52% for large-cap companies). Similar to prior years, voted proposals at small- and mid-cap companies received higher support (37% of votes cast vs. 19% for large-cap companies).

Once again, “anti-ESG” proponents focused almost exclusively on large-cap companies, submitting all but three proposals to companies in the S&P 500 (vs. six in H1 2024). Several large-cap companies faced multiple proposals from “anti-ESG” proponents. Consistent with 2024, “anti-ESG” proponents focused their attention on financial services companies (which received 28% of these proponents’ submissions), consumer goods/retail companies (24%) and technology companies (20%).

Focus on Retail, Tech and Financial Sector Companies. Consistent with last year, consumer goods/retail companies received the largest number of proposals overall. These companies received 30% of overall submissions (vs. 27% in H1 2024), a disproportionately high portion relative to their representation among the S&P Composite 1500 (19%). Consumer goods/retail companies also far surpassed all other industries in terms of ESP proposals. Consistent with last year, technology companies received the second-largest number of proposals overall (17% in both years) and companies in the financials sector received the third-largest number of proposals overall (15% vs. 17% in H1 2024). The number of proposals submitted at industrial companies decreased (11% vs. 14% in H1 2024), driven by a decrease in the environmental submissions. Environmental proposals comprised 3% of total submissions at industrial companies (vs. 24% in H1 2024).

Targets of Multiple Proposals. In H1 2025, 34 companies received five or more proposals (vs. 40 companies in H1 2024) and five companies[7] received 10 or more proposals (vs. 11 companies in H1 2024).

D. UPDATES TO RULE 14A-8 GUIDANCE

Staff Legal Bulletin No. 14M (“SLB 14M”). On February 12, 2025, the SEC published SLB 14M regarding the exclusion of Rule 14a-8 shareholder proposals under Rule 14a-8(i)(5) (“economic significance”) and Rule 14a-8(i)(7) (“ordinary business”). SLB 14M broadened the ability to exclude shareholder proposals on these bases by (1) rescinding Staff Legal Bulletin No. 14L (“SLB 14L”), which was issued on November 3, 2021 and narrowed the ability to exclude proposals with “broad societal impact” and (2) reinstating guidance previously rescinded by SLB 14L.[8]

The SEC issued SLB 14M mid-proxy season, after many companies’ deadlines for making a no-action request had passed. Nonetheless, the new guidance had a significant impact on this proxy season, in part because SLB 14M specifically noted that the SEC staff will consider the publication of the new guidance to be “good cause” for making a late request so long as the legal arguments in the request relate to the new guidance.

Increase in No-Action Requests. For the 2025 proxy season, no-action requests citing “ordinary business” increased by 44% (135 vs. 94 in H1 2024), comprising 41% of all no-action requests submitted, up from 26% in H1 2024. Requests citing “economic relevance,” which historically has been an infrequently used exclusionary basis, comprised 5% of all no-action requests this year, compared to just 1% during each of the last two proxy seasons. However, the success rates under both exclusionary bases decreased. Success rate for requests citing “ordinary business” fell from 71% for H1 2024 meetings to 65% for this proxy season. Whereas all three requests citing “economic relevance” for H1 2024 meetings were granted, the SEC concurred with only 15% of such requests for H1 2025 meetings. It remains to be seen whether success rates on these bases will increase in future years as companies and the SEC staff continue to adjust to the new guidance. In addition, while the release of the new guidance mathematically correlated with high withdrawal rates this proxy season,[9] it is difficult to quantify the extent to which the new guidance actually caused proponents to withdraw their submissions.

No-Action Requests on Social/Political Proposals. The rescission of SLB 14L also seemed to impact companies’ willingness to request no-action relief with respect to social/political proposals. SLB 14M shifted the focus from whether a proposal raises an issue with “broad societal impact” to an analysis of the company-specific significance of the issue.[10] As a result, with respect to proposals on social and political topics, companies requesting no-action relief did not need to demonstrate that the topic lacked general society significance, but could instead focus their analysis on the specific circumstances of the company. For H1 2025 meetings, requests to exclude social/political proposals more than doubled (155 vs. 77 for H1 2024 meetings), whereas those to exclude governance proposals remained level (95 vs. 94 in H1 2024). We observed similar trends in the success rates of social/political and governance proposals, with the percentage of successful requests increasing by 24% for social/political proposals but decreasing by 11% for governance proposals.

SEC Response Time. Notwithstanding the high volume of no-action requests and significant SEC staff reductions, the SEC’s average no-action response time this proxy season was 71 days, an increase of only one day from 2024. However, this average obscures the substantial variation throughout the season, particularly the slower response times in the first two months following the release of SLB 14M.

Link to the full report can be found here.

1In addition to company-specific proposals, this includes 19 proposal submitted by Chris Mueller focused on Computershare-related administrative matters, all of which have been excluded through the no-action process.(go back)

2See Section D.(go back)

3In this publication, we refer to a proposal as “passing” if it received a majority of votes cast, regardless of whether this is the threshold for shareholder action under state law or the company’s organizational documents.(go back)

4In this publication, we refer to a proponent as an “anti-ESG” proponent if the proponent’s official website states that it is asking companies to reconsider “ESG” or a “woke/liberal” agenda.(go back)

5On June 29, 2023, the Supreme Court issued its opinion in Students for Fair Admissions, Inc. v. President and Fellows of Harvard College, holding that the race-based admission programs of Harvard and the University of North Carolina violated the Equal Protection Clause of the Fourteenth Amendment and, by extension, Title VI of the Civil Rights Act of 1964 (which applies to programs receiving federal assistance). On the same day, the court held in Groff v. DeJoy that Title VII requires an employer who denies a religious accommodation to an employee to show that the burden of granting an accommodation would impose an “undue hardship on the conduct of the employer’s business” and that the hardship is “substantial in the overall context of the employer’s business.”(go back)

6In this publication, we refer to S&P 500 companies as “large-cap,” the next largest S&P 400 companies as “midcap” and the next largest S&P 600 companies as “small-cap.”(go back)

7Alphabet, Amazon, JPMorgan, Meta and Mondelez.(go back)

8In July 2022, the SEC also proposed to narrowed the “substantial implementation,” “duplication” and “resubmission” bases for excluding shareholder proposals under Rule 14a-8. On June 12, 2025, the SEC withdrew its proposed rulemaking, stating that it did not intend to issue final rules with respect to this proposal.(go back)

9Companies withdrew 46% of no-action requests after obtaining a withdrawal from the proponent (vs. 22% for H1 2024). Based on public information, it is more difficult to accurately quantify the number on withdrawals of proposals where companies did not seek to exclude via the SEC.(go back)

10Whereas SLB 14L emphasized the consideration of whether a proposal “raises issues with broad society impact,” SLB 14M focuses on a more company-specific approach. With respect to “economic relevance,” SLB 14M states that, for proposals that “raise social or ethical issues,” a proponent “would need to tie those matters to a significant effect on the company’s business” in order to avoid exclusion under Rule 14a-8(i)(5), and “[t]he mere possibility of reputational or economic harm alone will not demonstrate that a proposal is ‘otherwise significantly related to the company’s business.’” In contrast, the Staff “would generally view substantive governance matters to be significantly related to almost all companies.” With respect to “ordinary business,” SLB 14M states that the SEC staff “will take a company-specific approach in evaluating significance, rather than focusing solely on whether a proposal raises a policy issue with broad societal impact or whether particular issues or categories of issues are universally ‘significant.’”(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.