DEI in Transition: 2025 Corporate Diversity Disclosure Trends

This report draws on recent disclosure data to examine how US public companies are recalibrating public reporting on diversity, equity & inclusion (DEI)—focusing on shifts in language, workforce and board demographic disclosures, board oversight structures, and executive compensation practices.

Trusted Insights for What’s Ahead®

- Corporate public DEI messaging and communications are undergoing a legal- and risk-driven reframing in 2025, with companies reducing the visibility of DEI language while selectively preserving or embedding related goals in ways that are more cautious, controlled, and defensible.

- Companies are taking a more cautious approach to workforce demographic disclosures, with a significant proportion narrowing their reporting on women in management and overall workforce diversity while maintaining internal tracking and data collection.

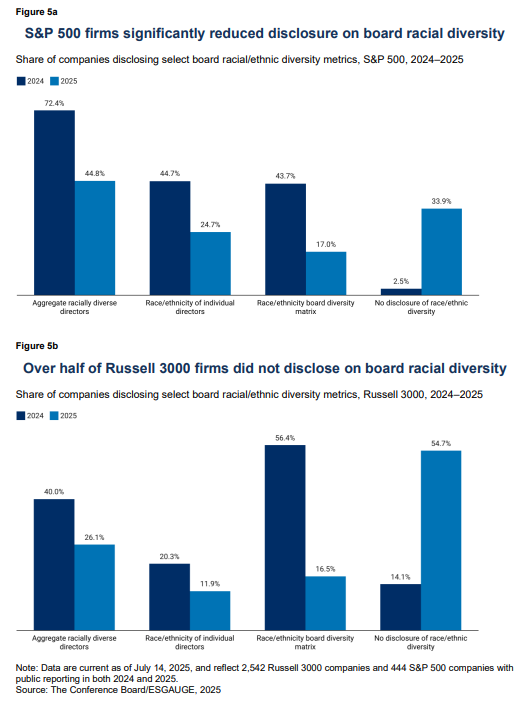

- So far in 2025, board demographic diversity disclosures have plummeted—particularly on gender and race—driven by legal rulings, softened investor expectations, and rising litigation risk; by contrast, more companies are disclosing formal board committee oversight of DEI, reflecting a shift toward embedding DEI into internal governance to manage risk and enhance legal defensibility.

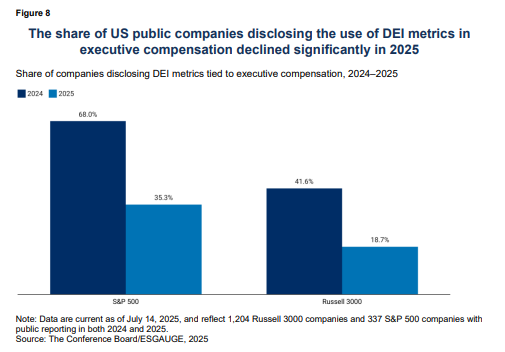

- Disclosure of DEI-linked executive pay incentives declined sharply in 2025 amid legal and reputational concerns, although some firms appear to be reframing incentives around broader human capital priorities such as talent development and employee engagement.

Evolving Context for Corporate DEIThe US environment for corporate DEI has shifted markedly. A key inflection point was the 2023 Supreme Court decision striking down affirmative action in college admissions, which prompted broader corporate reassessment of race- and identity-conscious programs. In 2025, pressures have intensified as the new administration has moved to roll back DEI-related initiatives through executive orders, federal guidance, and expanded oversight of contractors and grant recipients. Companies now face heightened legal and enforcement risk, leading many to recalibrate DEI strategies and messaging. This report examines how these shifts are reflected in 2025 disclosures by US public companies, drawing on data from TCB Benchmarking powered by ESGAUGE and supplemented by additional research. |

New Approaches to Language and Messaging

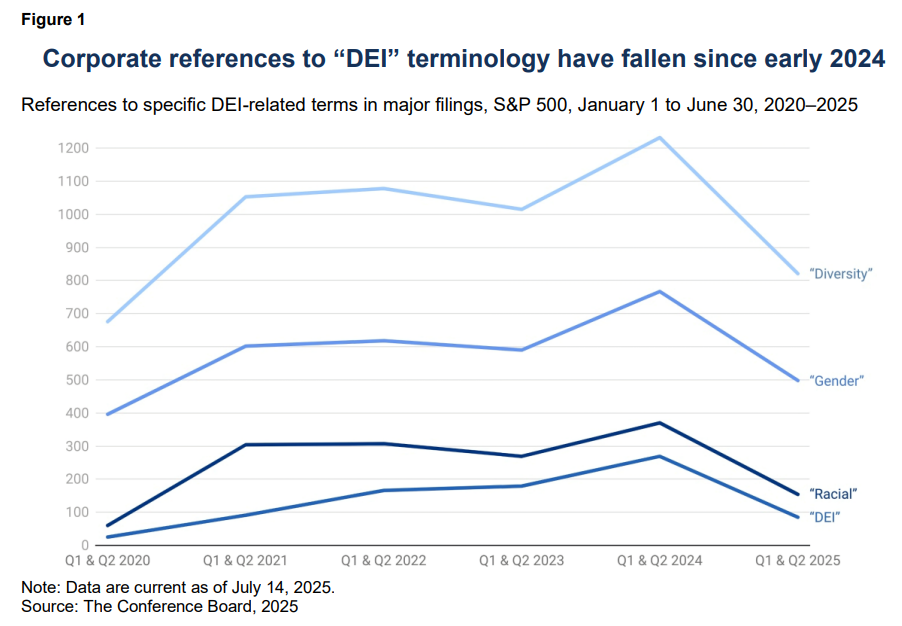

As the landscape for diversity efforts in the US has evolved in 2025, many companies have adapted by refining how they present these initiatives in public communications and filings— often by reducing the use of explicitly racial or DEI-branded terms to mitigate legal exposure and reputational risk (Figure 1). The sharp decline in references to “diversity,” “racial,” “gender,” or “DEI” indicates a strategic distancing away from terminology viewed as politically sensitive.

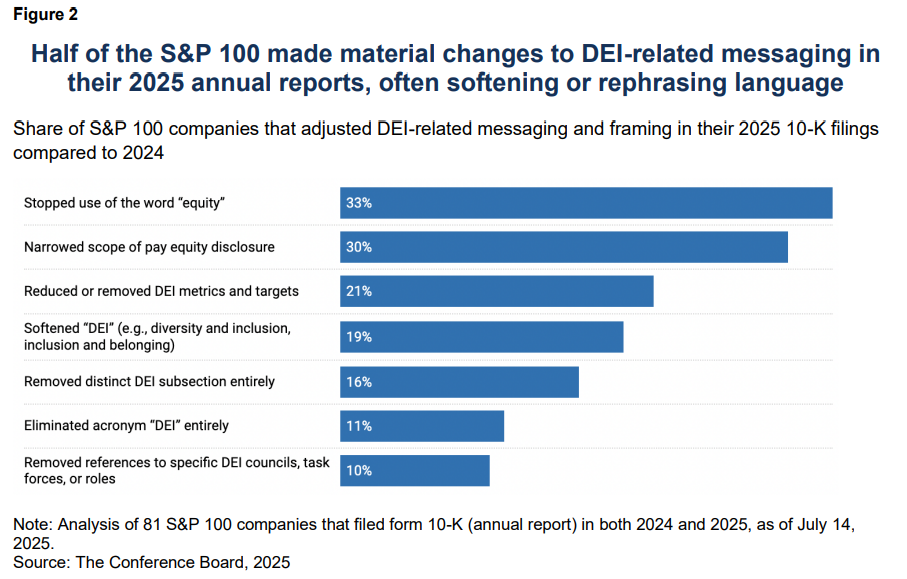

A review of 2025 Form 10-Ks filed by the 100 largest US public companies further highlights an ongoing shift in how DEI is framed and presented. More than half (53%) made material adjustments to DEI-related messaging, structure, or terminology compared to the prior year, reflecting a broader recalibration amid legal, political, and reputational pressures (Figure 2).

The most common change was the removal of the term “equity,” with one-third eliminating it entirely as it becomes increasingly viewed as sensitive language in regulated disclosures. Others softened use of the “DEI” acronym, favoring alternatives such as “inclusion and belonging,” while 11% removed the acronym altogether. Structural changes were also evident: 16% eliminated a dedicated DEI subsection, and 10% removed references to DEI councils or task forces—perhaps to reduce visibility in a heightened risk environment.

These changes vary by industry. For example, only 31% of health care companies in the S&P 100 made substantial adjustments in 2025, suggesting greater continuity—likely driven by ongoing stakeholder expectations and regulatory focus on workforce equity in patient-facing environments. In contrast, 78% of information technology firms made notable changes, often removing or reframing DEI language, reflecting that sector’s heightened exposure to political scrutiny, legal risk, and reputational sensitivity. Overall, the data point to a strategic reframing of DEI communications, with disclosure decisions increasingly shaped by legal and compliance considerations and DEI language more tightly controlled and centrally vetted.

Workforce Demographic Disclosures

In recent years, many US public companies have voluntarily disclosed workforce demographic data—such as gender and race representation across roles and leadership levels—to enhance transparency, meet stakeholder expectations, and manage reputational and compliance risks. These disclosures, typically drawn from EEO-1 reports or internal HR systems, are often published in sustainability reports, DEI updates, or stand-alone workforce disclosures.

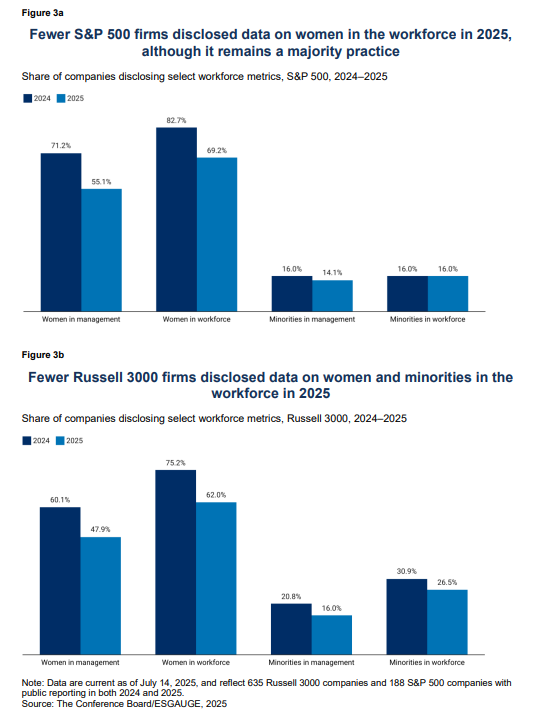

In 2025, however, the share of companies reporting key workforce diversity metrics fell compared to 2024, across both the S&P 500 and Russell 3000 (Figures 3a and 3b). The most notable reductions occurred in disclosures on women in management and the overall workforce. Disclosures on minority representation in management also declined slightly, while reporting on minority representation in the broader workforce remained steady. Companies appear increasingly cautious about publishing sensitive demographic data amid intensifying legal, political, and reputational scrutiny.

While this shift does not suggest a wholesale retreat from workforce transparency—disclosure of metrics on women remains a majority practice, particularly among larger companies—it points to a more careful and risk-sensitive approach. The decision not to disclose certain metrics, while it aligns with current compliance expectations, may carry longer-term costs by weakening stakeholder trust (including current and potential employees), limiting internal accountability, and complicating engagement with institutional investors and global regulators who may continue to expect robust human capital disclosures.

Corporate leaders should ideally take a measured approach, aligning public disclosures with evolving legal requirements and risk tolerance while maintaining strong internal data collection and analysis to guide strategy, ensure oversight, and prepare for shifting stakeholder and regulatory expectations. At the same time, companies must navigate the added challenge of sustaining an inclusive employer brand—ensuring that changes in external messaging do not undermine their ability to attract and retain diverse talent, particularly in a climate where HR, recruiting, and communications strategies are under heightened scrutiny.

Board Diversity Disclosures

Disclosure of demographic diversity among corporate board directors—particularly gender and racial/ethnic composition—has recently become a major focus for many US public companies. Investors, proxy advisors, regulators, and other stakeholders have viewed these disclosures as an indicator of board independence, decision-making quality, and alignment with evolving expectations around representation. Consequently, disclosures have expanded from basic aggregate counts to include self-identified characteristics, year-over-year comparisons, and matrix formats in proxy statements.

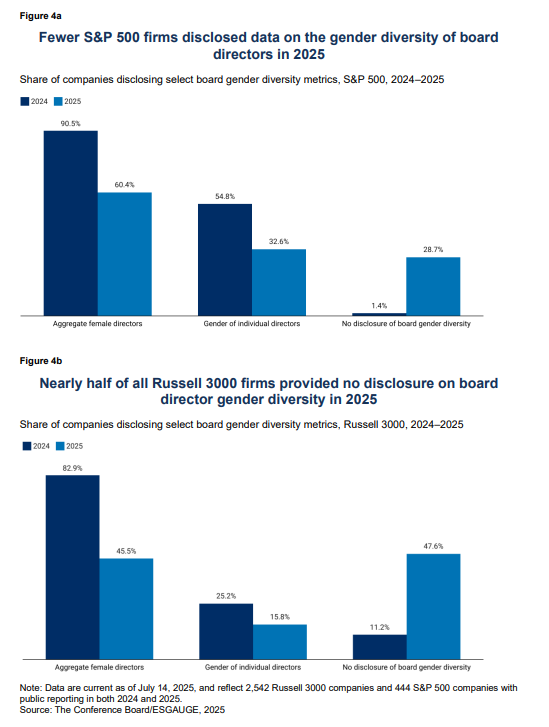

In 2025, however, momentum has slowed. The US Court of Appeals for the Fifth Circuit’s December 2024 decision striking down Nasdaq’s board diversity rule removed a key regulatory incentive; proxy advisors ISS and Glass Lewis eased or paused voting policies tied to board diversity metrics; and major asset managers such as BlackRock and Vanguard have dropped formal diversity targets in favor of more flexible, principles-based guidance.

Against this backdrop, board diversity disclosure practices have shifted. Even among the S&P 500—historically the most transparent—disclosure rates have declined sharply; for example, the share disclosing aggregate numbers of female directors fell by 30 percentage points. While many companies continue to report some demographic data on their boards, this pullback reflects growing legal caution amid litigation risks and challenges to diversity-related policies.

Disclosures of racial and ethnic diversity declined even more sharply than those on gender, particularly in the use of matrix formats and named individual data (Figures 5a and 5b). This likely reflects greater legal uncertainty, political sensitivity, and reputational risk associated with racial categorization amid ongoing affirmative action–related litigation. In the Russell 3000, nearly half of companies now disclose no board gender data (47.6%), and over half disclose no racial or ethnic data (54.7%)—a marked change from just a year ago. For many firms, even basic demographic transparency increasingly appears to be viewed as a potential liability.

The sharp decline in board diversity disclosures reflects a broader recalibration as companies navigate heightened legal and political scrutiny. While greater caution is understandable, a full retreat from transparency risks alienating key stakeholders, including institutional investors— many of whom have scaled back formal board diversity requirements but may still maintain baseline expectations around board composition as a marker of governance quality. At the same time, demographic diversity is not the only dimension that matters: companies should approach and disclose board diversity in a broad sense, including functional background, expertise, international experience, and lived perspectives.

Board Committee Oversight Disclosures

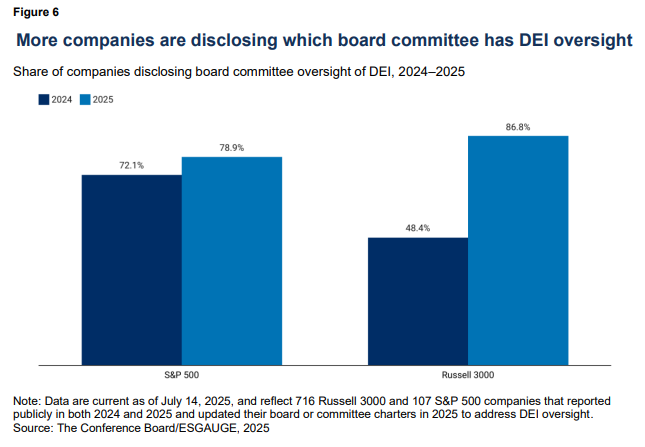

Disclosures on board oversight of DEI—and how that oversight is embedded within board committee structures—provides insight into how companies are recalibrating in 2025. While many have scaled back public-facing DEI language and commitments, more reported formal board committee oversight of DEI, with year-over-year increases across both the S&P 500 and Russell 3000, particularly the latter. This suggests that even as external messaging grows more cautious, governance is being strengthened to manage risks and enhance legal defensibility.

While overall disclosures of board committee oversight of DEI increased, the upward trend masks a more nuanced pattern: 11 S&P 500 companies and 28 Russell 3000 companies that had previously identified a DEI oversight committee did not do so in 2025. In contrast, 45 S&P 500 and 108 Russell 3000 companies reported oversight structures in both years, while 15 S&P 500 and 138 Russell 3000 companies introduced formal oversight for the first time in 2025.

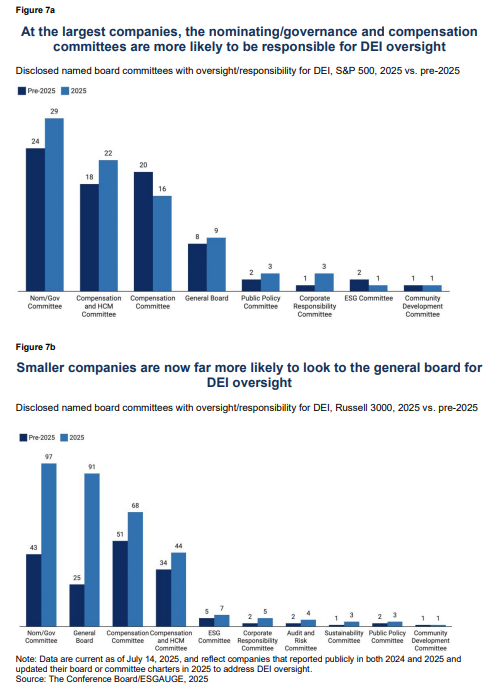

Across both indexes, oversight was most often assigned to the nominating and governance committee, followed by compensation-related committees and the full board. A growing number of firms rely on multiple committees or cross-functional bodies, including emerging structures such as corporate responsibility, public policy, sustainability, or ESG committees (Figures 7a and 7b). In the S&P 500, 20 companies disclosed DEI oversight through multiple board committees in 2025 (up from 16 in 2024), while 78 companies in the Russell 3000 did so, highlighting a trend toward more distributed and integrated governance models.

Executive Compensation Disclosures

In recent years, many US public companies—particularly in the S&P 500—have linked executive compensation to DEI-related goals, often through short-term incentive plans tied to workforce representation, pay equity, and related priorities. While these metrics were typically qualitative or lightly weighted, they signaled board-level commitment and strategic alignment.

In 2025, however, public disclosure of DEI-linked pay incentives has declined sharply, especially among large-cap companies (Figure 8). This reflects growing legal and reputational concerns, as some critics—including shareholders and political activists—argue that tying compensation to demographic outcomes could raise fiduciary or employment law challenges by incentivizing race- or gender-based employment decisions. In response, many boards have reassessed the defensibility and strategic relevance of these metrics.

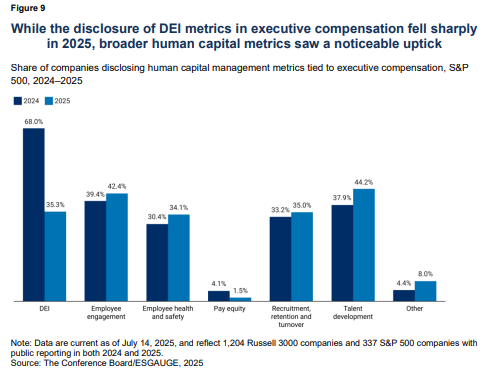

While DEI-specific incentives have receded, this may represent a shift in framing rather than a wholesale retreat. Notably, more companies in 2025 are linking compensation to broader human capital goals, such as talent development and employee engagement (Figure 9). Incentivizing these broader outcomes can help reinforce a strong organizational culture while advancing broad-based opportunity and access. Boards and management teams must navigate this evolving landscape carefully, ensuring that human capital incentives remain clearly defined, legally sound, and aligned with long-term business goals—requiring close coordination among legal, HR, and compensation committees.

Conclusion

Amid a complex legal and political environment, analysis of 2025 public disclosures indicates that US public companies are neither abandoning DEI altogether nor preserving past practices unchanged. Instead, they are selectively reframing commitments, reducing public exposure, and embedding oversight more discreetly but concretely into governance and human capital management. This shift reflects an evolution from external signaling to disciplined, risk-sensitive internalization. Going forward, corporate leaders must balance legal defensibility and stakeholder expectations while ensuring human capital governance remains aligned with long-term business priorities.

At the same time, this recalibration raises the risk of growing misalignment with international disclosure standards—such as the EU Corporate Sustainability Reporting Directive (CSRD), Global Reporting Initiative (GRI), and the International Sustainability Standards Board (ISSB)— which continue to emphasize workforce DEI as material indicators of corporate accountability. These frameworks often require more detailed and consistent demographic reporting than many US firms now provide. For multinationals, this divergence could complicate compliance and stakeholder engagement, increasing the potential for reputational risk, investor pressure, and compliance burdens across global operations.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.