2025 Review of Shareholder Activism

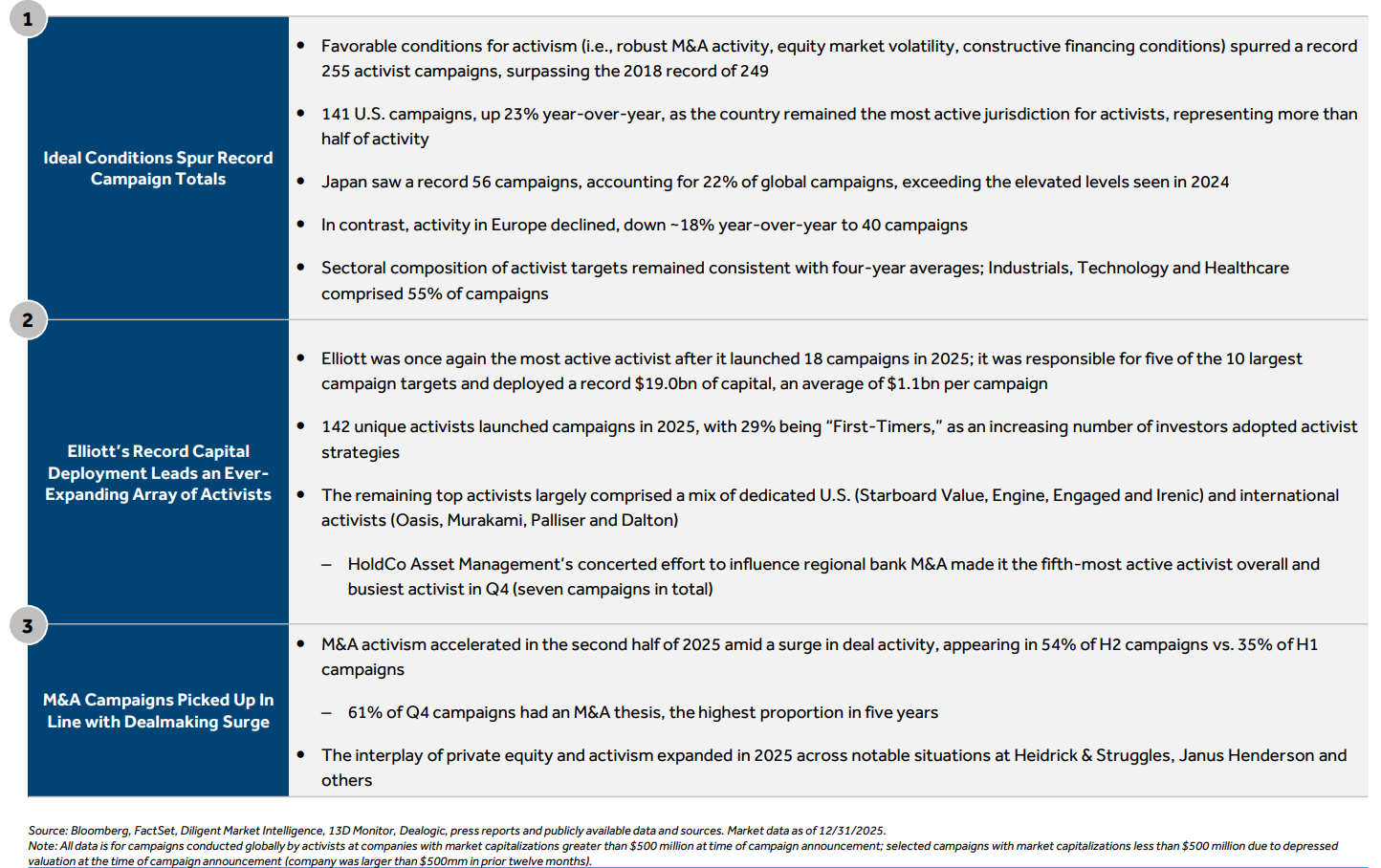

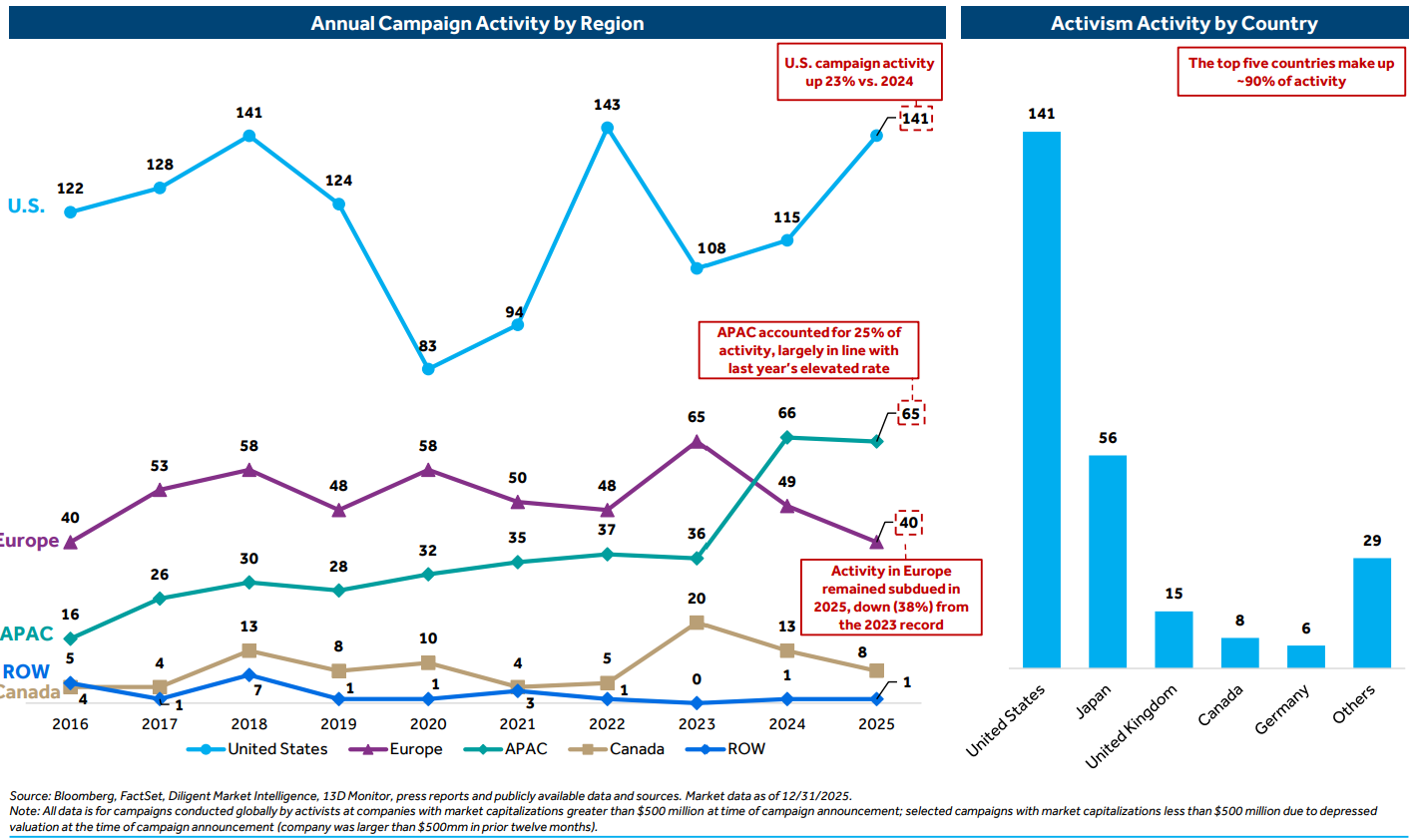

Observations on the Global Activism Environment in 2025

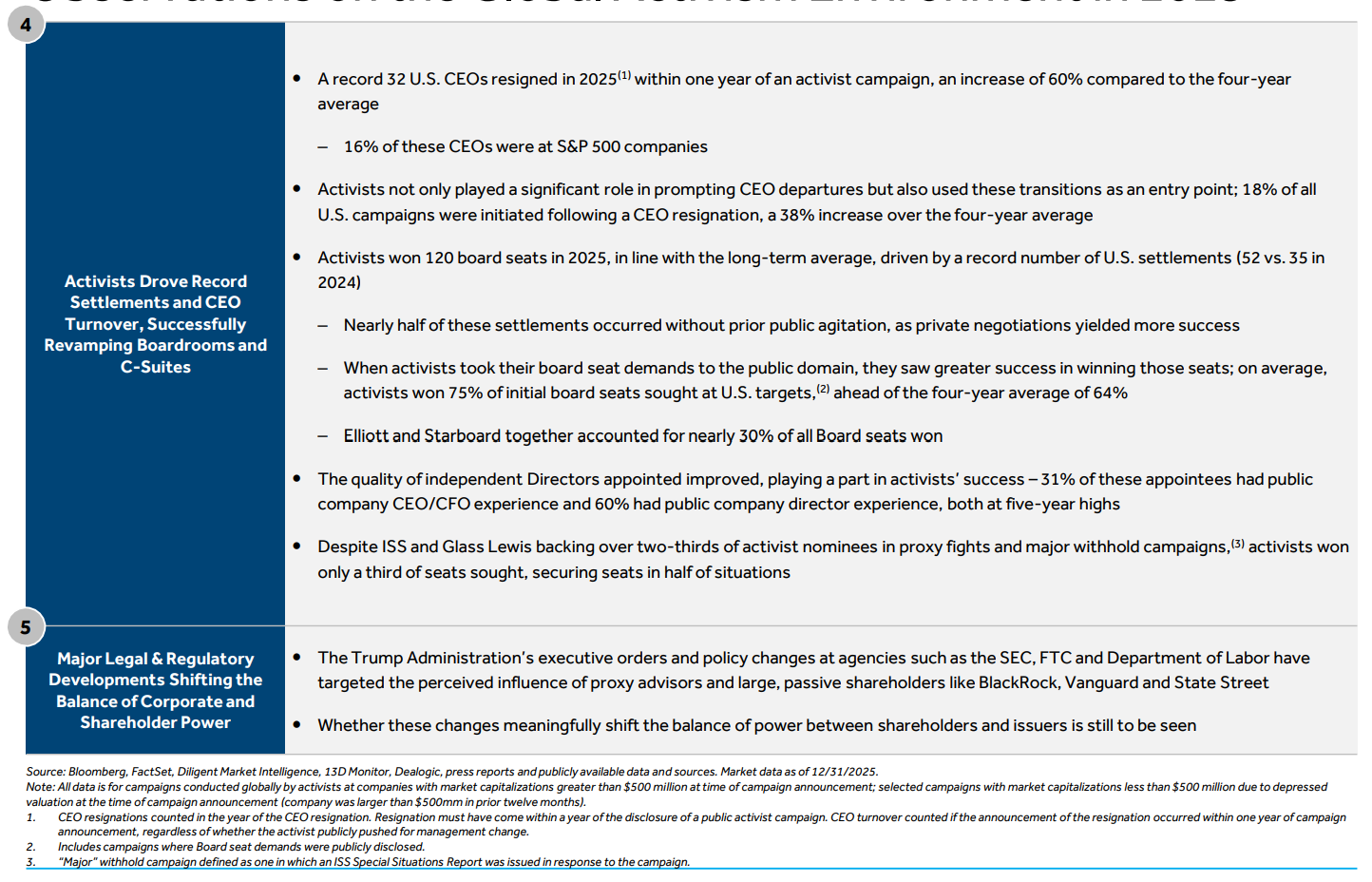

Record Year for Activism

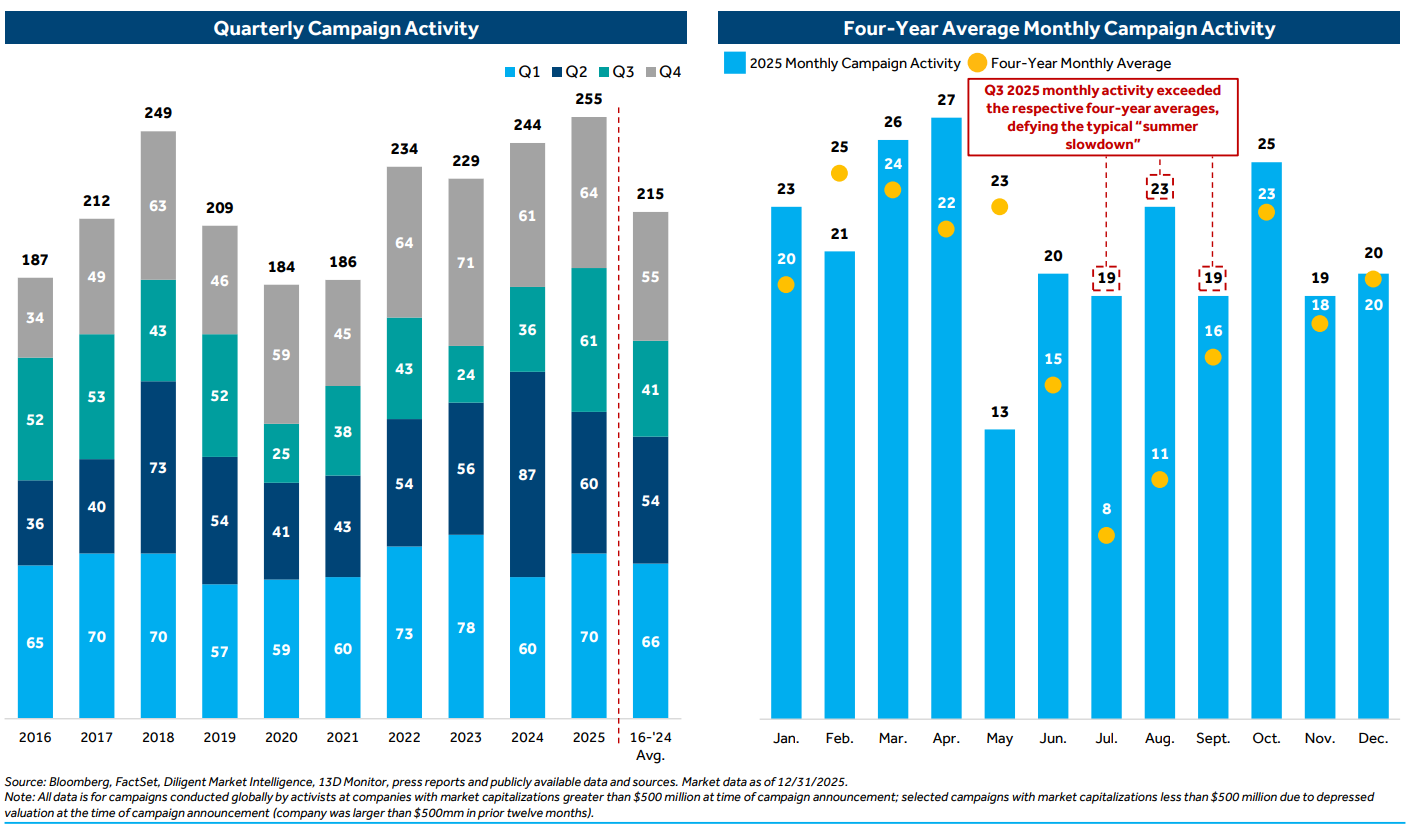

2025 set a record for activist activity with 255 campaigns, surpassing the previous high of 249 in 2018

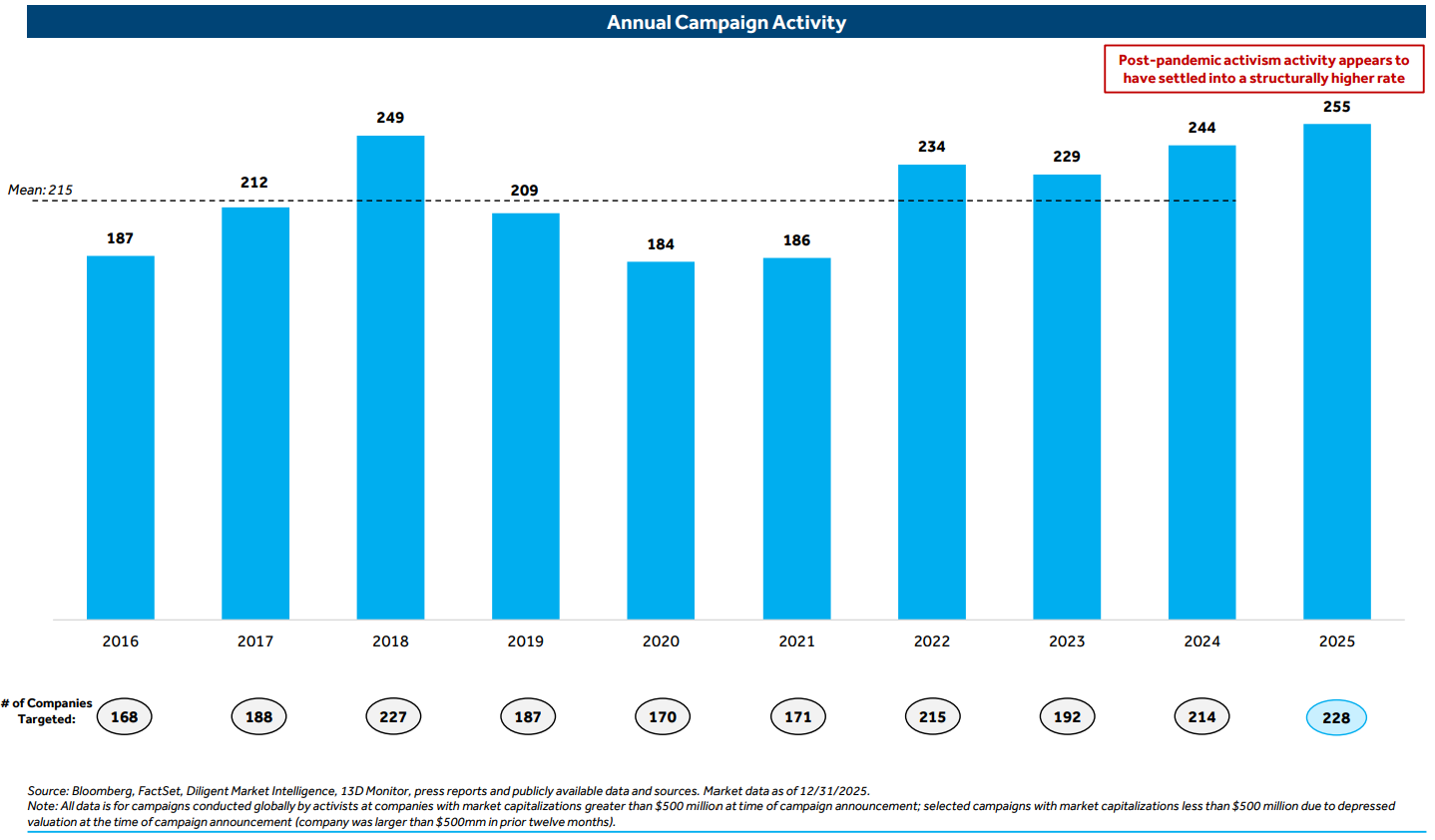

U.S. Continues to Drive Global Activity

Activity in the U.S. accounted for 55% of all campaigns; the elevated pace of activity in APAC last year continued in 2025

Activist Activity by Quarter and Month

Quarterly activity was consistently above average throughout the year, including a record Q3

Activist Activity by Sector

Industrials remains the focal point for activists, consistent with historical trends

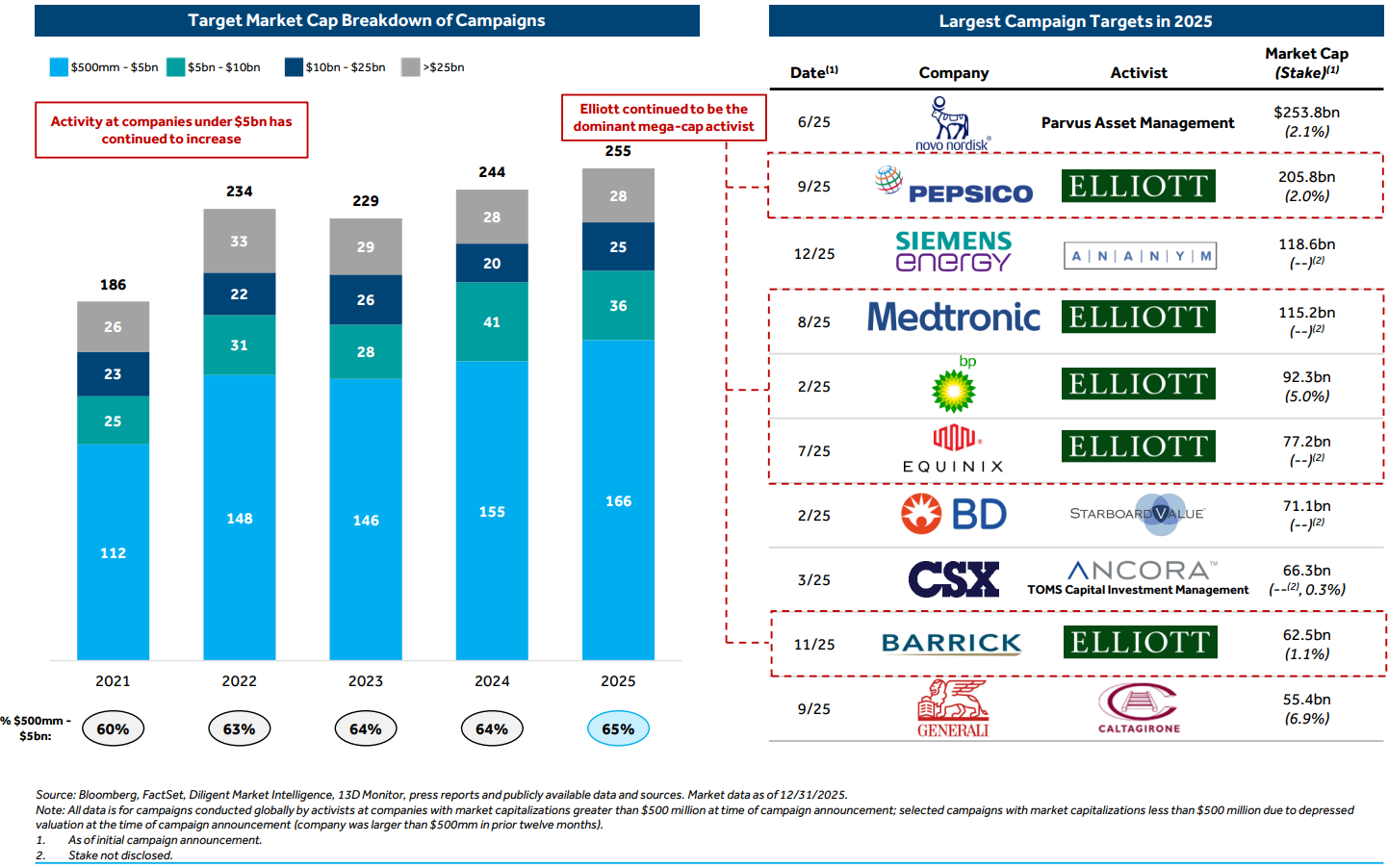

Activist Targets by Company Size

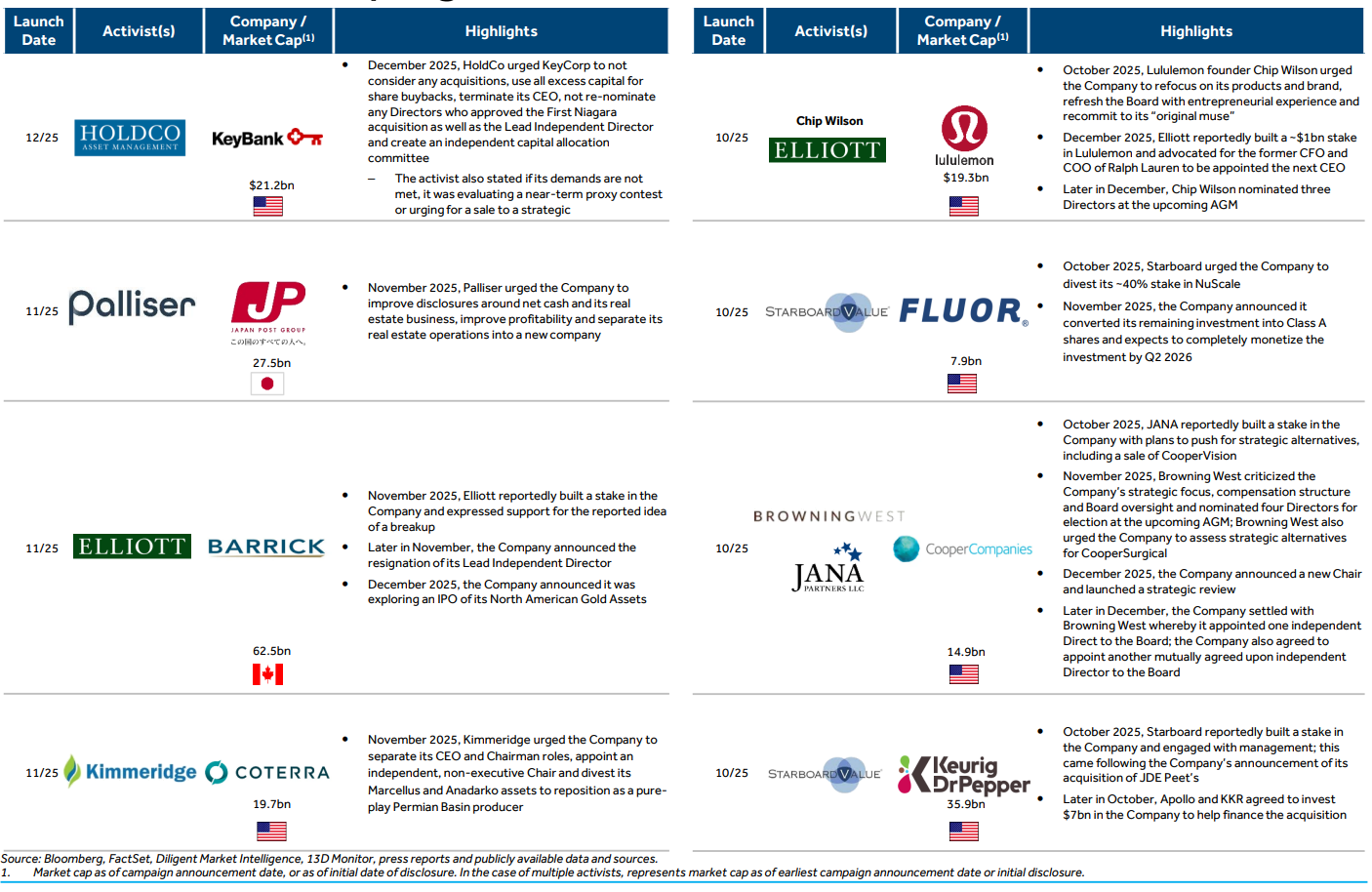

Notable Q4 Campaign Launches

Notable Q4 Campaign Developments

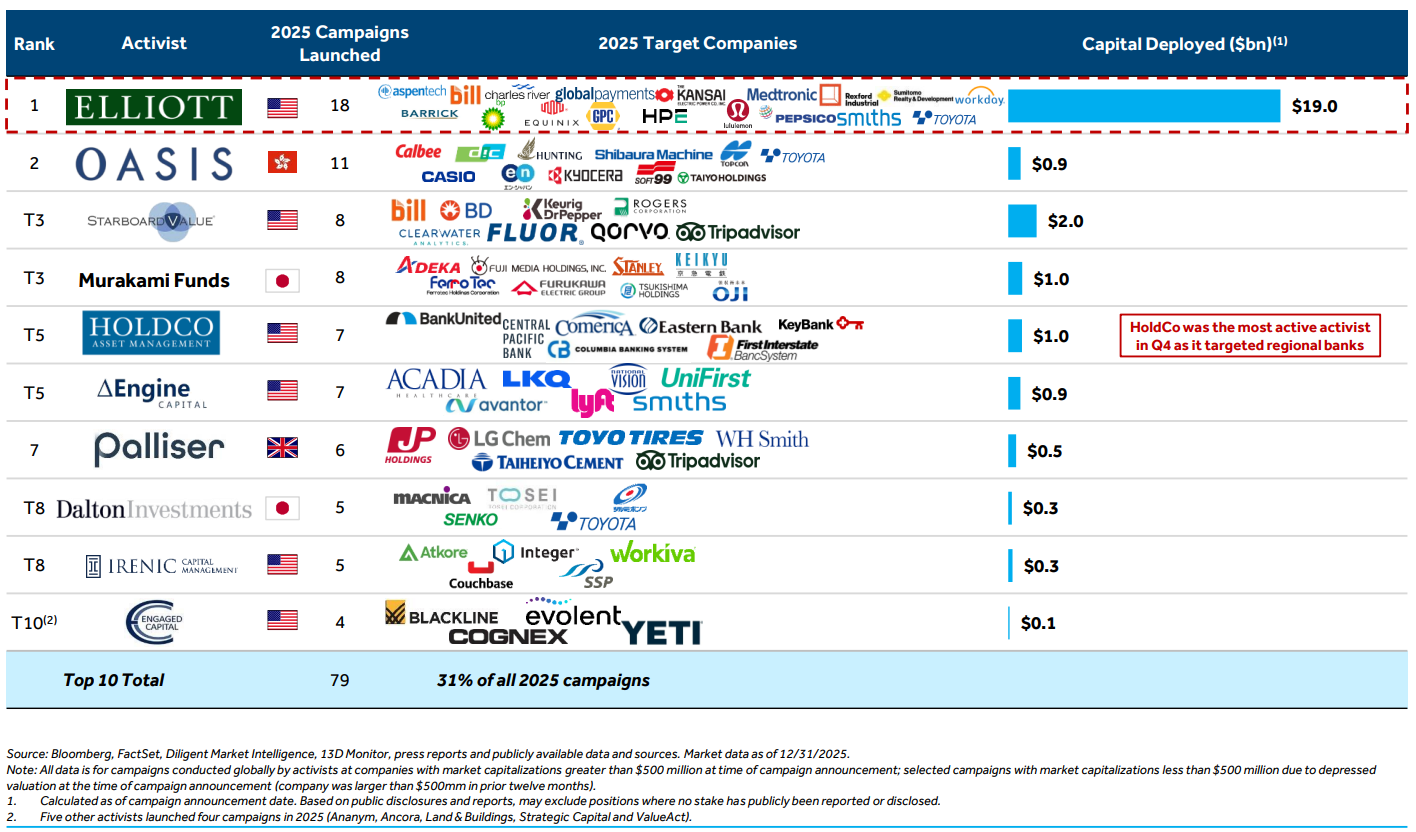

Top Activists of 2025

Elliott deployed a record $19.0bn of capital across 18 campaigns, leading a diverse array of U.S. and international activists

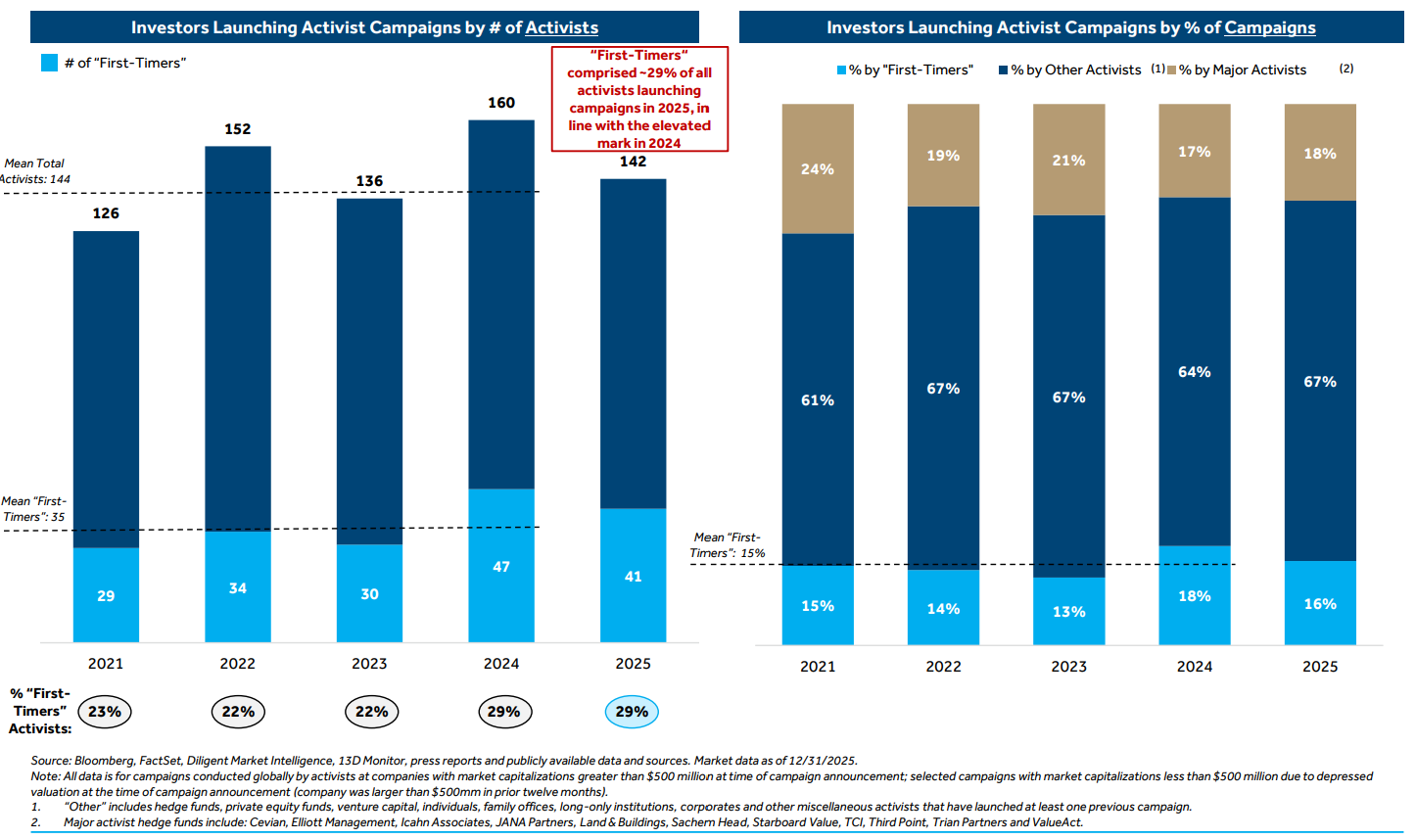

Global Activist Universe

“First-Timer” activity remained elevated as new activists continued to enter the fray

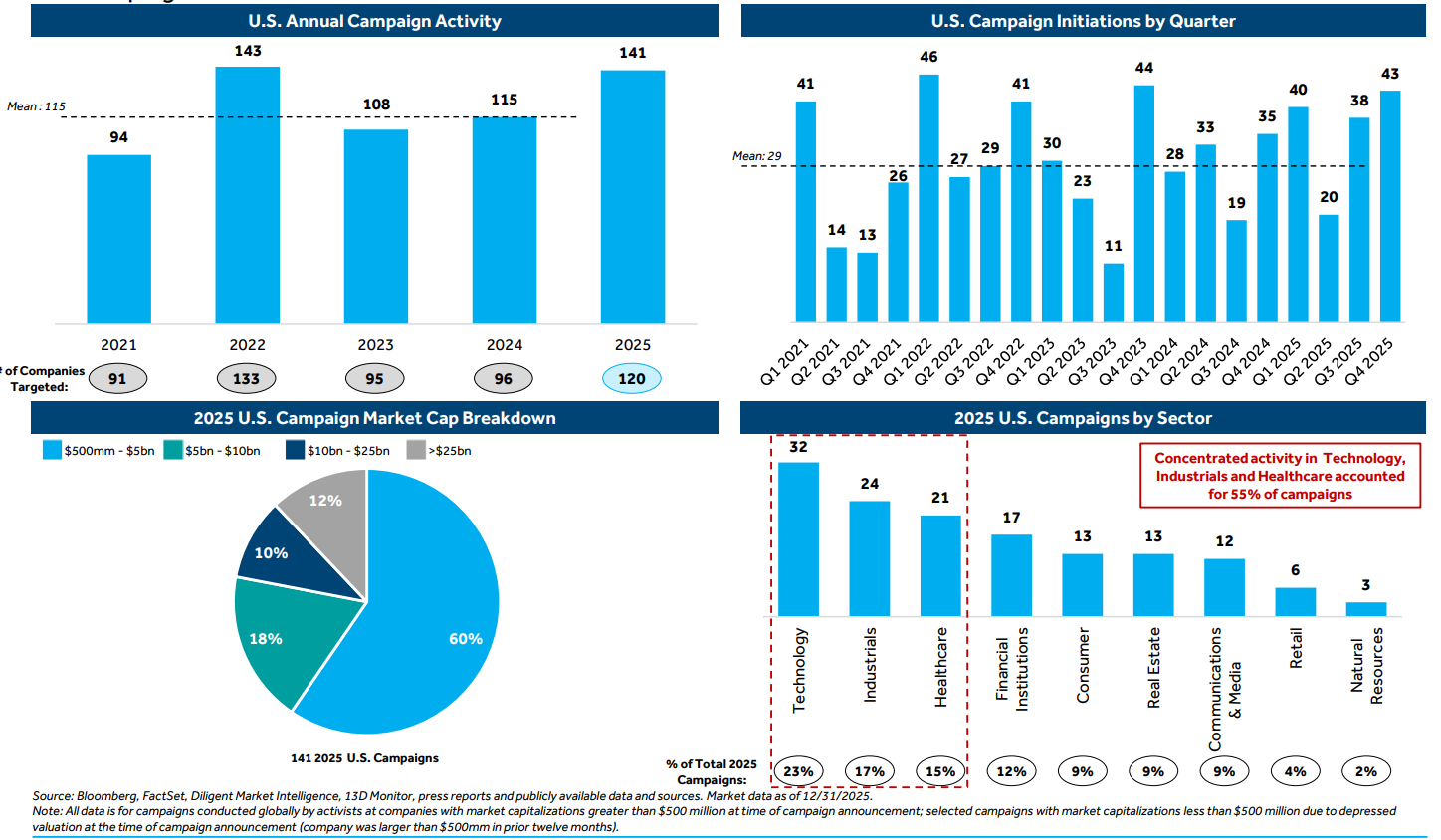

U.S. Campaign Activity

U.S. campaign activity was 23% above the four-year average; 141 campaigns this year was only slightly below the record of 143 campaigns in 2022

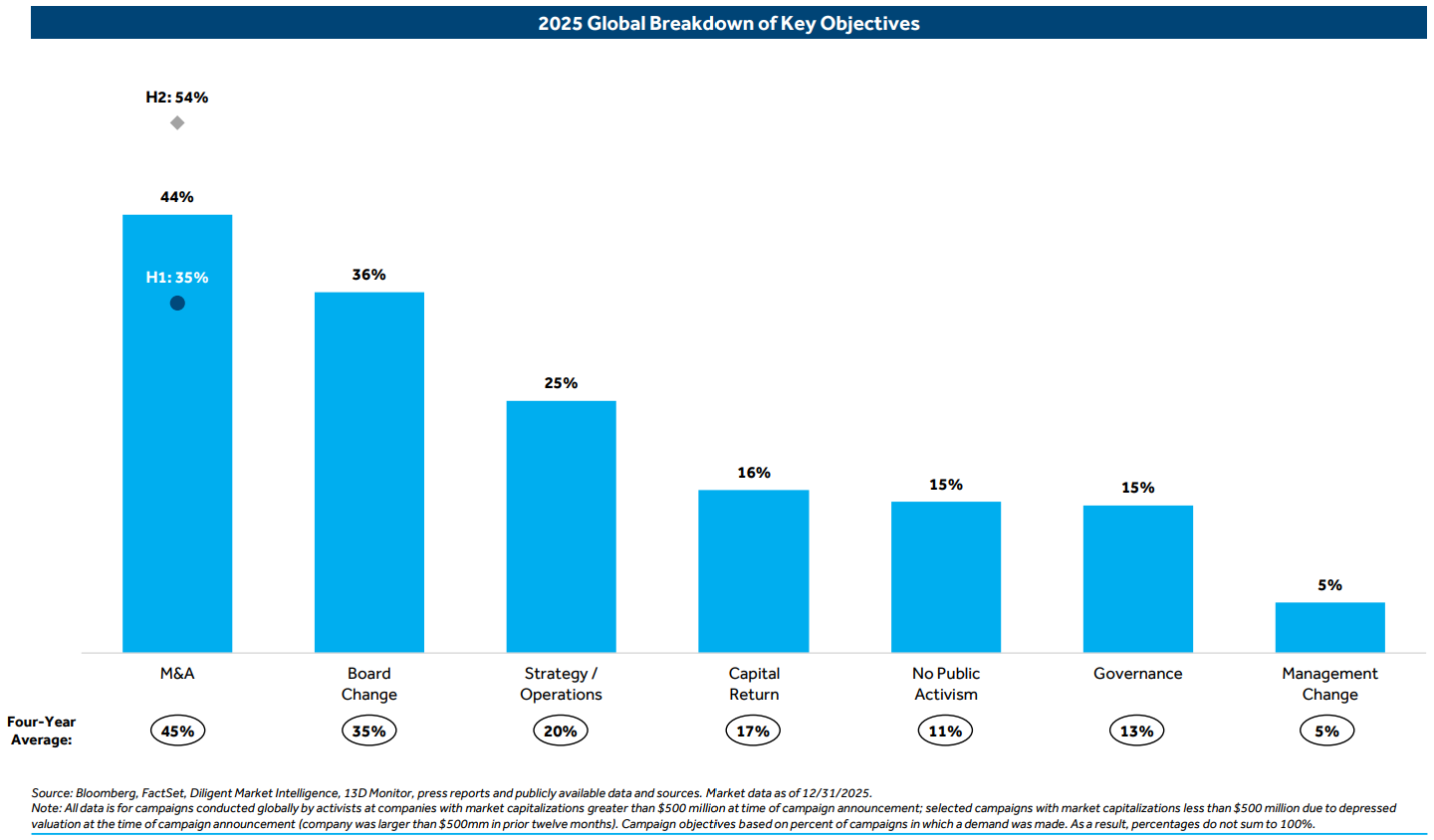

Key Campaign Objectives in 2025

M&A demands rebounded in H2, featuring in 54% of campaigns, to end the year in line with the four-year average

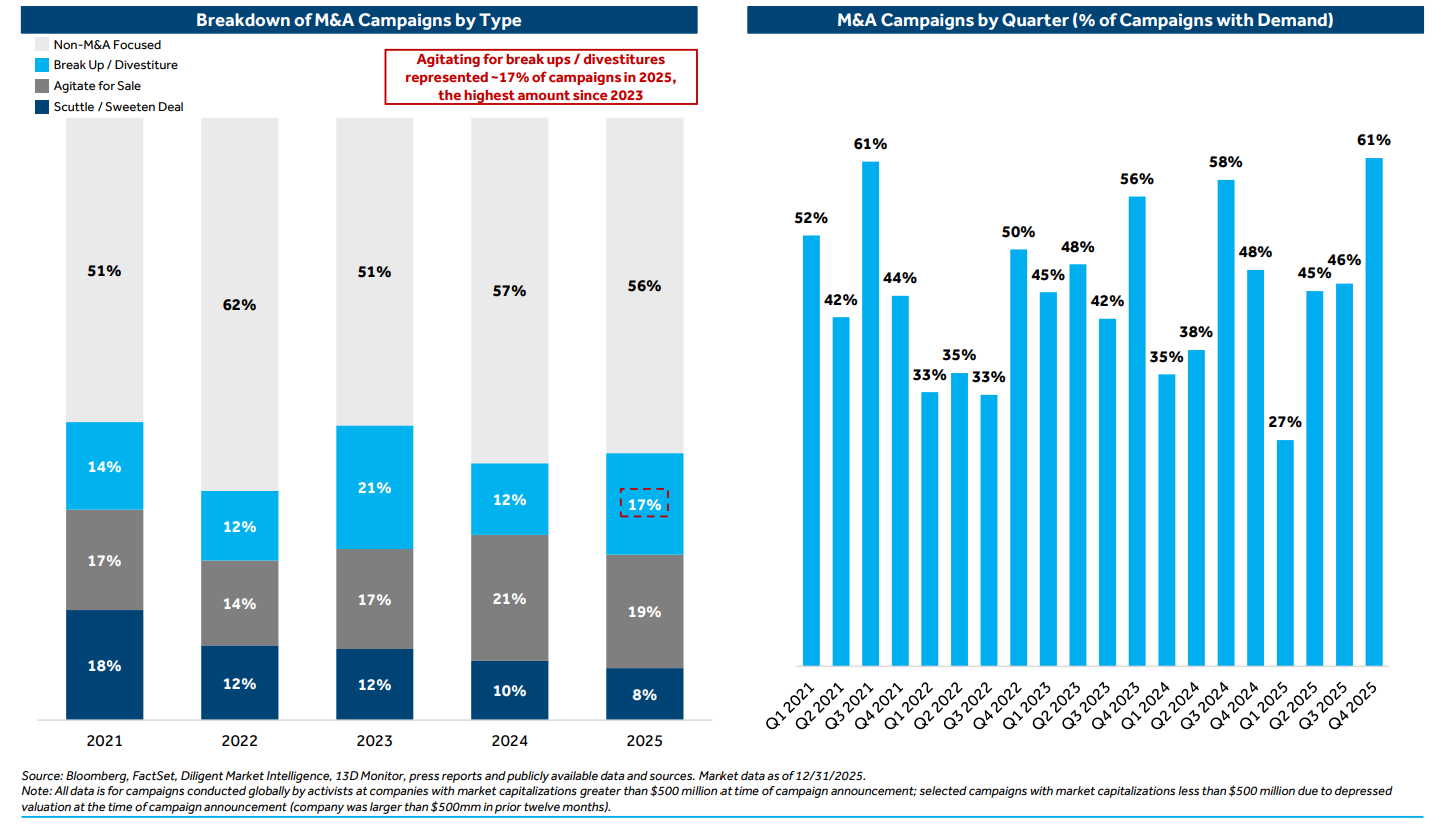

Global M&A Campaign Activity

Q4 2025 was the busiest quarter in the last five years for M&A related campaigns, appearing in 61% of campaigns

Activists Spur Record CEO Turnover

32 U.S. CEOs resigned within a year of an activist campaign being launched, surpassing the previous record of 27 set in 2024

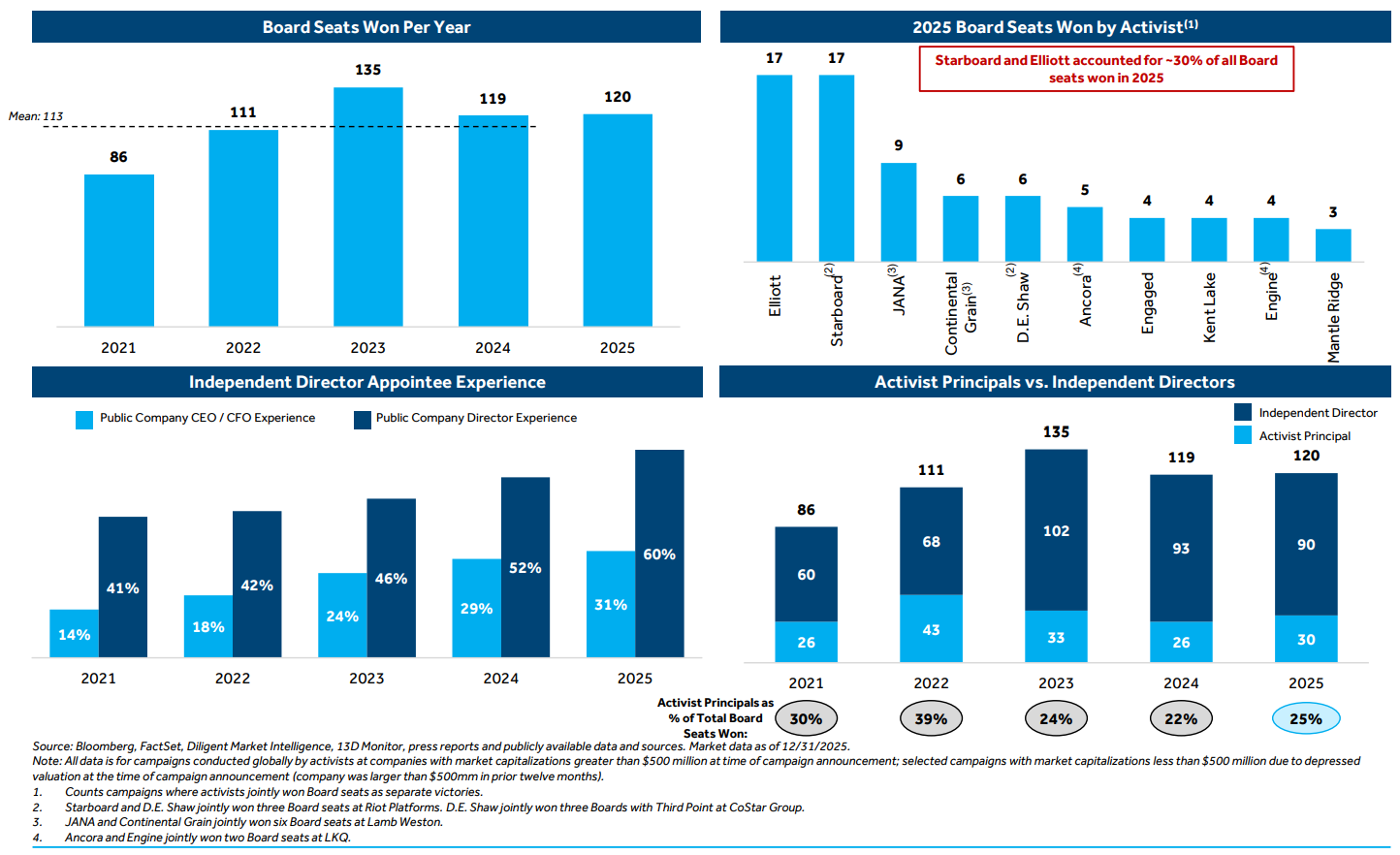

Global Board Seats Won

The number of board seats won in 2025 was in line with the four-year average

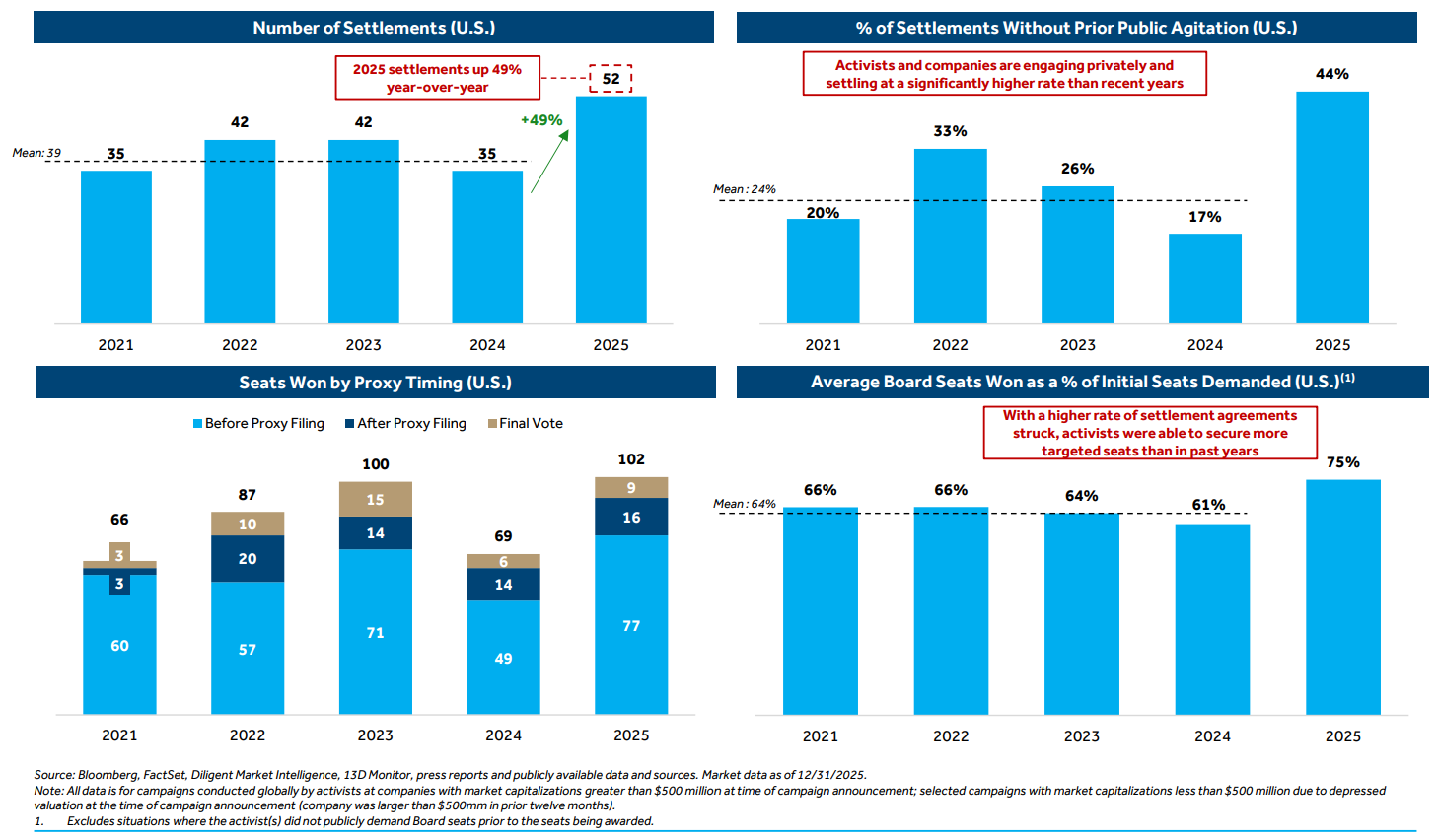

U.S. Settlements Reach a Record High

52 settlements is the most on record, driven by a rise in settlements without prior public agitation

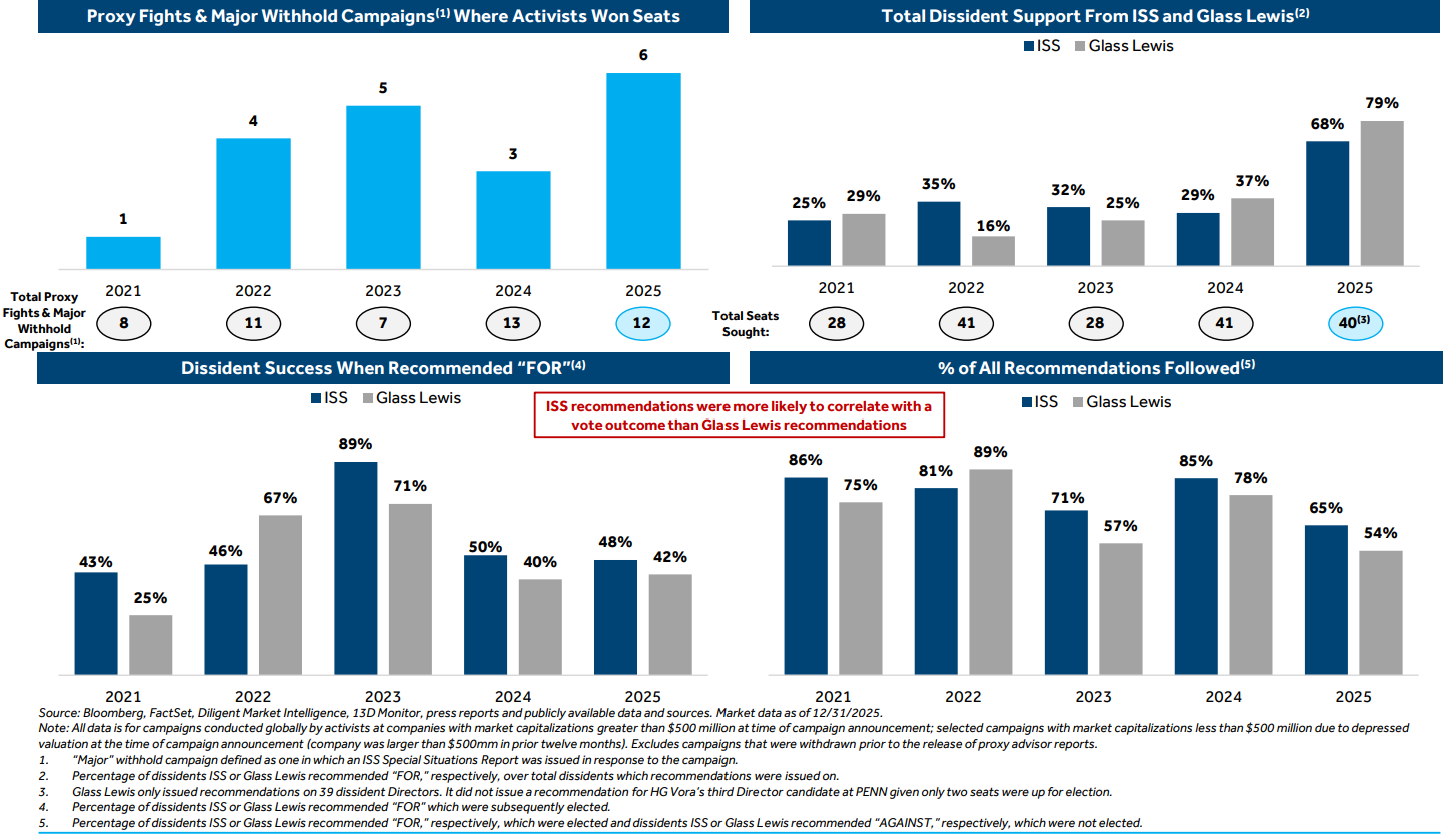

2025 U.S. Proxy Fights & Major Withhold Campaigns Results

Proxy Advisors’ Influence Decreased in 2025

ISS and Glass Lewis were significantly more likely to back dissident nominees in 2025 but their support was relatively less meaningful in determining outcomes

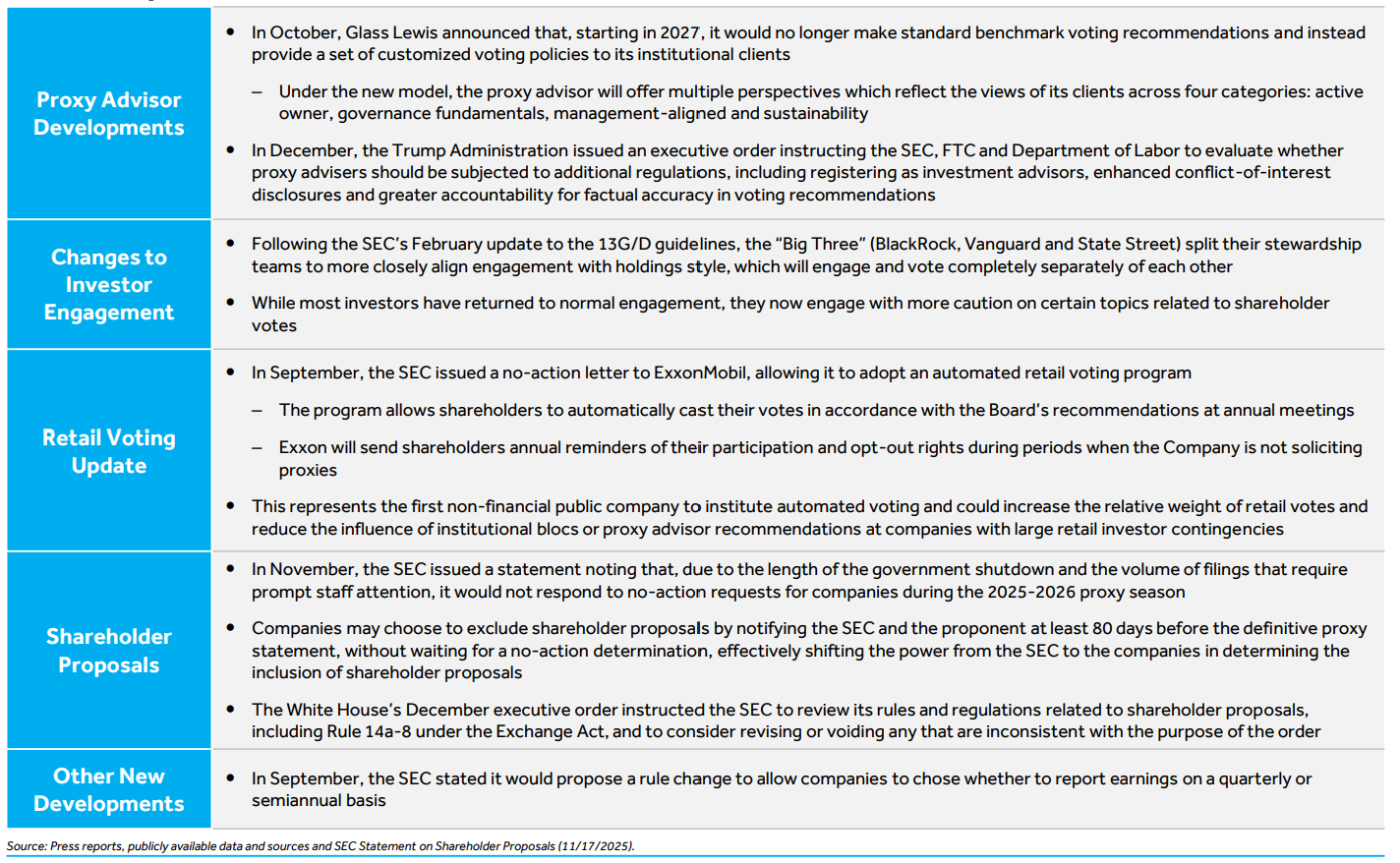

Major Legal & Regulatory Developments Shifting the Balance of Corporate and Shareholder Power

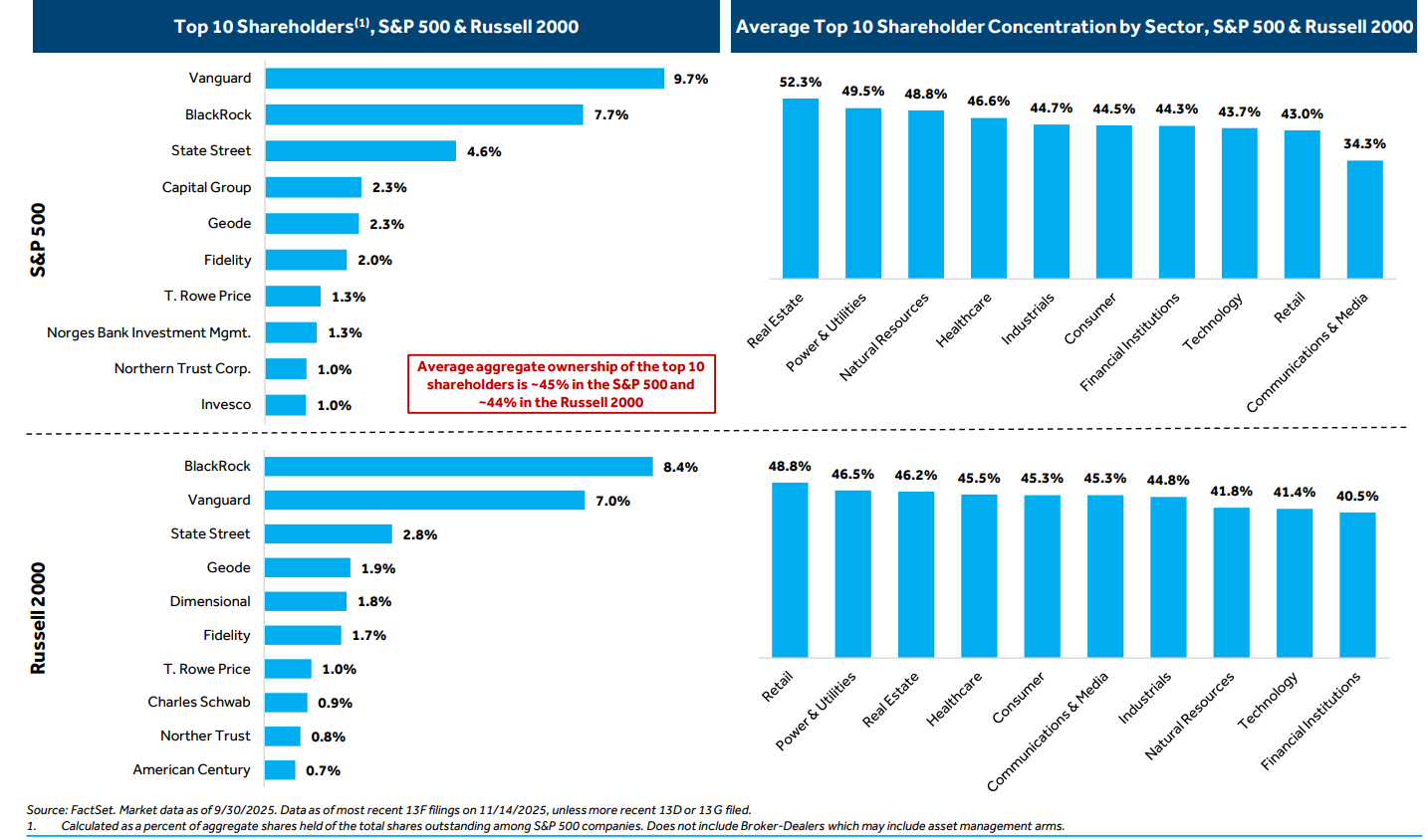

Shareholder Bases Are More Passive and Concentrated

The “Big Three” (BlackRock, Vanguard, State Street) are the top shareholders of both the S&P 500 and Russell 2000, as passive investing concentrates ownership in fewer hands

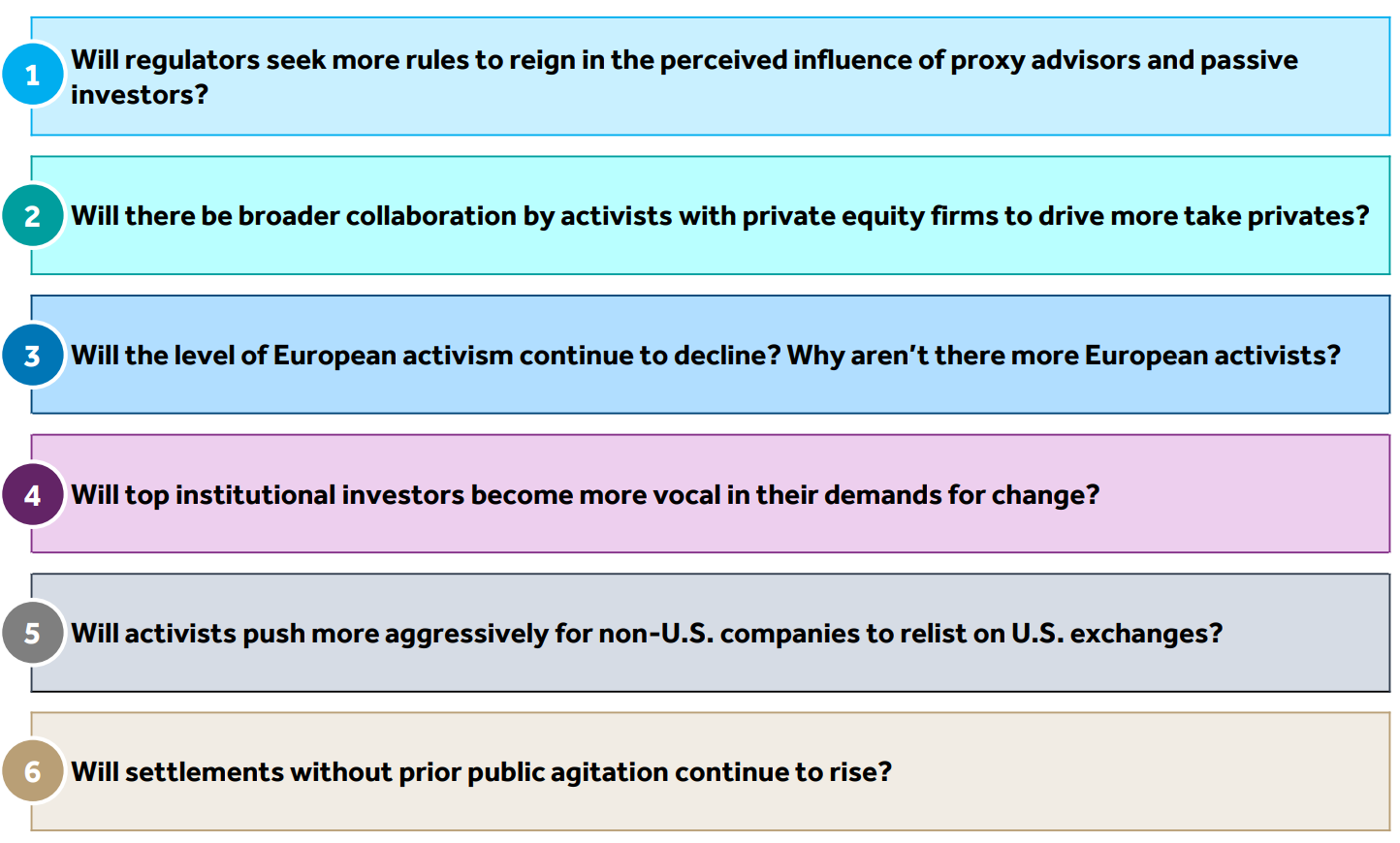

Top Questions for 2026

Link to the full report can be found here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.